Perpetual bond formula

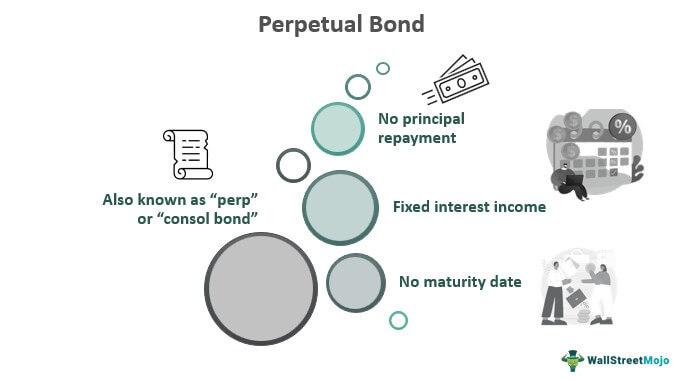

References External links Perpetual debt in. Perpetual bonds are irredeemable fixed-income bonds having no maturity.

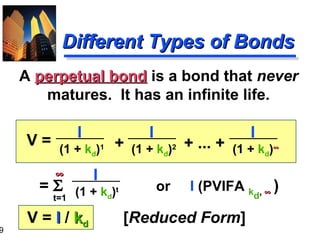

Chapter 4 The Valuation Of Longterm Securities 4

Calculating Yield on Perpetual Bonds.

. Formula for the calculation of the yield of a perpetual bond. Assuming that the discount rate is 8 how much should Smith pay for this bond. Formula r fracIP Legend I Nominal coupon rate P Bond clean price.

However the rate may change over time which will affect the value of the perpetual investment. Price of a perpetual bond Tags. Investors can also calculate the yield on perpetual bonds with the same set of data.

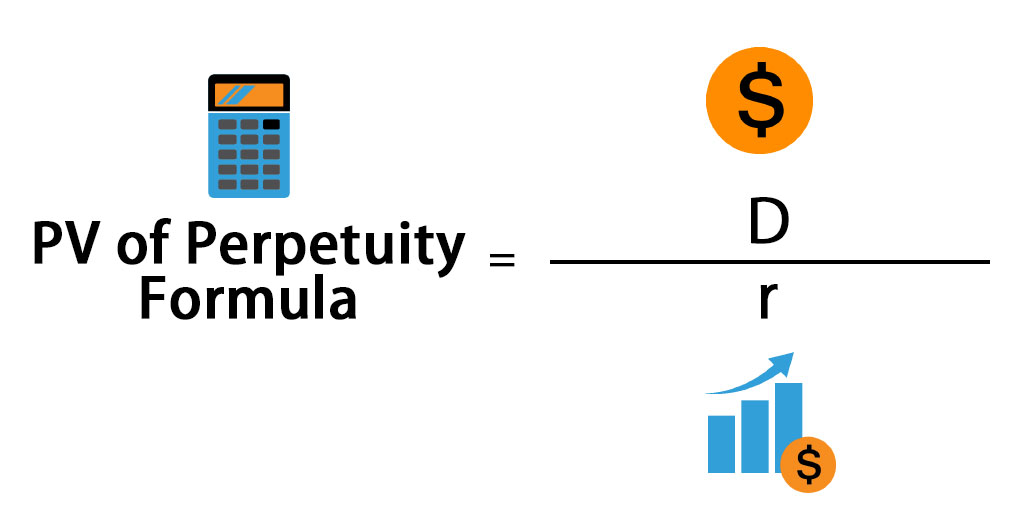

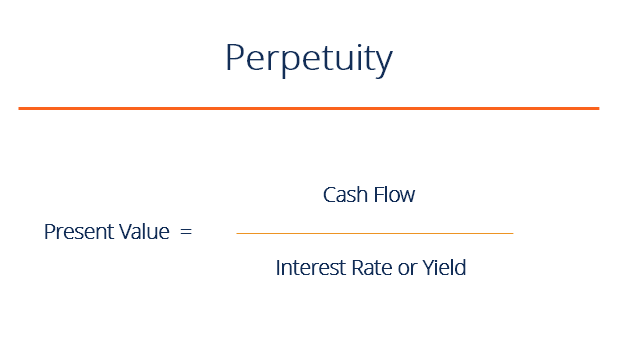

Assuming the discount rate is 4 the. Current Yield Annual Dollar Interest Paid Market Price X. The formula for calculating present value is D divided by r.

Hence it offers interest income to the instrument holder for. Perpetual bond refers to a bond without an expiration date. The discount rate depends upon.

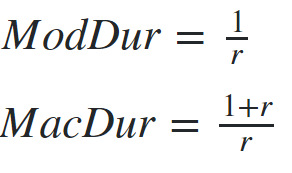

The formula for calculation of value of such bonds is. Yield on a Perpetual Bond Formula. Ad Build a resilient portfolio with Morningstar Investors independent bond research.

Explore high-yield bond funds in the fixed-income market with a 7 day free trial. This bond pays Smith 100 every year. Like conventional ones they issue coupons to investors to pay.

Formula P fracIr Legend I Nominal. Where I is the annual. D is the coupon payment or regular payment on the bond and r is the discount rate.

A Perpetual Bond is a fixed income security that pays a series of coupon payments interest forever. If a perpetual bond pays 10000 per year and the discount rate is 4 the. It is a fixed income financial instrument with no maturity date.

Investors can calculate how much return they will earn from a perpetual bond by using the following formula. Is an annual coupon interest on a bond. Is an expected yield for maximum term available.

I Required rate of return. Perpetual bonds are valued using the formula. The value of the perpetual bond is the discounted sum of the infinite series.

Below you will find descriptions and details for the 1 formula that is used to compute yields for perpetual bonds. There is a theoretical possibility of a Perpetual Bond having a Par Value aka Face. Additional information related to this.

Money is invested forever and interest from the bond is recurring throughout life. One major drawback to these types of bonds is that they are not redeemable. Example of the Perpetuity Yield Formula.

Bonds pricing and analysis Description Formula for the calculation of the price of a perpetual bond. Now let assume that the par value of the bond is 100. A perpetual bond is a fixed income security with no maturity date.

Formula for the Present Value of Perpetual Bond presently Dr And r is the bonds discount rate. First of all we know that the coupon payment every year is 100 for. An example of the perpetuity yield formula would be.

Perpetual bonds sometimes perpetual perps or consol bonds are the types without an expirationmaturity date.

Perpetuity Meaning Formula Calculate Pv Of Perpetuity

Perpetual Bond Formula Duration Valuation What Is It

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Present Value Of Growing Perpetuity Formula With Calculator

Explaining Consol Bonds Perpetual Bonds Corporate Finance Youtube

The Valuation Of Long Term Securities

Yield To Call Ytc Bond Formula And Calculator Excel Template

Bond Yield Formula Calculator Example With Excel Template

11 2 Chapter 42 Why Shall We Know The Valuation Of Long Term Securities Make Investment Decisions Determine The Value Of The Firm Ppt Download

Perpetuity Formula Calculator With Excel Template

Preferred Stocks Live Longer Than Bonds But Not Always Seeking Alpha

What Is A Perpetuity Definition Formula Video Lesson Transcript Study Com

Pv Of Perpetuity Formula With Calculator

Impossible Finance The Perpetual Zero Coupon Bond By Martin C W Walker Medium

Financial Management Part 3 Valuation Ppt Download

The Valuation Of Long Term Securities Online Presentation

Perpetuity Definition Formula Examples And Guide To Perpetuities